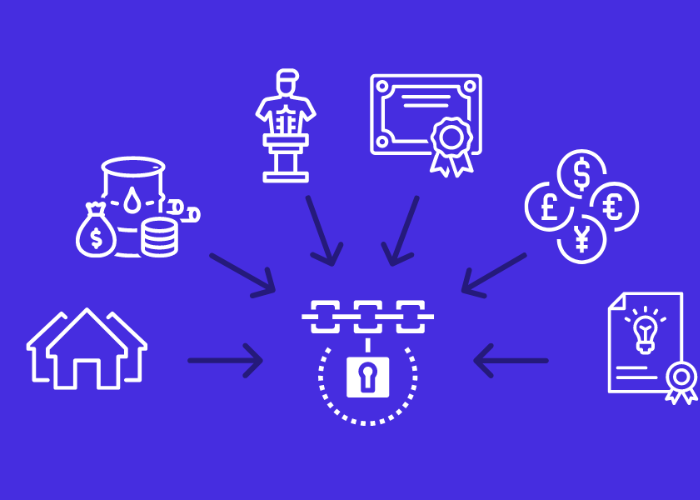

Asset tokenization is revolutionizing the way we invest, trade, and transfer value. It’s a process that converts real-world assets into digital tokens on a blockchain. This technology promises to bring about a paradigm shift in the global economy by making illiquid assets liquid, removing intermediaries, and democratizing access to investment opportunities worldwide.

Tokenization can convert any value stored in physical or non-physical assets into a digital token. This digital token represents the asset on a blockchain, ensuring the security, immutability, and transparency of the asset’s ownership and value. It could be anything from real estate to pieces of art, company stock, or even tokenized bitcoin.

What is Asset Tokenization?

Asset tokenization refers to the process of converting physical assets or rights to an asset into digital tokens on a blockchain. For example, a building worth $10 million can be tokenized into 10 million tokens, each representing a $1 share of the building. This process makes it possible for individuals to buy and sell fractions of the asset, increasing its liquidity and accessibility.

The digital tokens created through asset tokenization are typically represented as security tokens, a type of cryptocurrency that represents ownership in an external asset or company. These tokens often confer rights to the owner, such as dividends or interest payments. The tokens can be traded, sold, or held as investments on various cryptocurrency exchanges and platforms that support security tokens.

Advantages of Asset Tokenization

Asset tokenization offers numerous advantages over traditional methods of dealing with assets. One of the primary benefits is increased liquidity. Traditional assets, such as real estate or art, are often illiquid and require significant time and effort to convert into cash. Tokenization allows these assets to be divided into smaller, more manageable shares that can be easily bought and sold on secondary markets, thereby increasing their liquidity.

Additionally, tokenization enables fractional ownership, allowing investors to buy and sell portions of an asset rather than the entire asset itself. This opens up investment opportunities to a broader audience who may not have the financial means to purchase entire assets. This democratization of asset ownership can lead to more diversified portfolios and increased investment opportunities for people worldwide.

Challenges and Limitations

Despite its potential benefits, asset tokenization also comes with its share of challenges and limitations. One significant challenge is regulatory uncertainty. The legal framework surrounding tokenized assets is still evolving, and there is a lack of clear guidelines and regulations in many jurisdictions. This can make it difficult for companies and individuals to navigate the legal landscape and can lead to hesitation in adopting this new technology.

Another challenge is technological barriers. The process of tokenizing an asset and managing it on a blockchain requires a certain level of technological expertise that many individuals and small companies may not possess. This can lead to a reliance on third-party service providers, which can increase costs and potentially introduce new risks.

Regulatory Considerations

Regulatory considerations are paramount when it comes to asset tokenization. As tokenized assets are often classified as securities, they must comply with the relevant securities laws and regulations in the jurisdictions in which they are offered. This can involve complex legal and regulatory processes, including registering the tokens as securities, conducting due diligence on investors, and providing detailed disclosure documents.

Tax implications are another important consideration. The tax treatment of tokenized assets may vary from one jurisdiction to another, and it is essential for both issuers and investors to understand the tax implications of buying, selling, and holding tokenized assets. This may involve consulting tax professionals and obtaining legal advice.

Use Cases

Real estate is one of the most promising use cases for asset tokenization. Real estate assets are typically illiquid, expensive, and involve significant transaction costs. Tokenization can help overcome these challenges by enabling fractional ownership, reducing transaction costs, and increasing liquidity. Investors can buy and sell fractions of real estate properties on secondary markets, enabling more flexible investment strategies and broader access to the real estate market.

Art and collectibles are another area where asset tokenization can have a significant impact. High-value artworks and collectibles are often out of reach for all but the wealthiest investors. Tokenization allows these assets to be divided into smaller, more affordable shares, opening up investment opportunities to a broader audience and enabling artists and collectors to monetize their assets more effectively.

Security and Risk Management

Ensuring the security of tokens and the underlying asset is a crucial aspect of asset tokenization. This involves implementing robust security measures to protect against hacking, fraud, and other cyber threats. Additionally, it is essential to have a comprehensive risk management strategy in place to address potential risks associated with the asset itself, such as market fluctuations, legal risks, and operational risks.

Managing risks associated with asset tokenization involves a multi-faceted approach. It includes conducting thorough due diligence on the underlying asset, implementing robust legal and contractual frameworks, and using secure and reliable technology platforms. Additionally, it may involve obtaining insurance coverage for certain risks and implementing appropriate safeguards to protect investors’ interests.

Conclusion

Asset tokenization has the potential to revolutionize the way we invest, trade, and transfer value. It offers numerous benefits, including increased liquidity, fractional ownership, and broader access to investment opportunities. However, there are also challenges and limitations that need to be addressed, including regulatory uncertainty, technological barriers, and the need for robust security and risk management measures.

As the technology and regulatory landscape evolve, we can expect to see continued growth and innovation in the field of asset tokenization. The integration with DeFi applications and the emergence of tokenization platforms are promising trends that can help accelerate the adoption of this technology and unlock its full potential.